Top considerations

for alternatives in 2023 – Private debt

“Success is where preparation and opportunity meet” — Bobby

Unser, Motorsports Hall of Fame

automobile racer

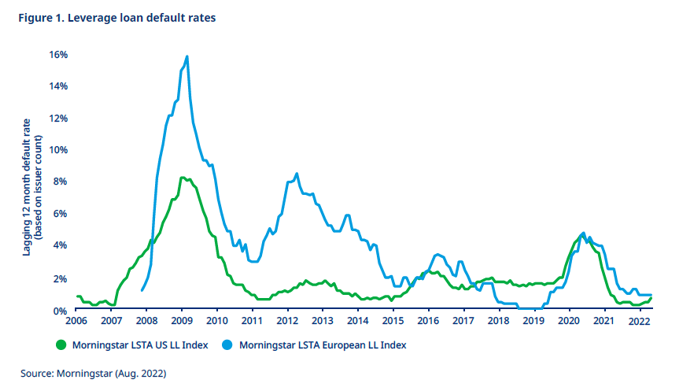

During 2022, the initial anxiety around whether or not inflation

would prove to be transitory rapidly transformed into substantial concern that

a tectonic shift in global monetary policy could result in a hard landing for

economic growth. Following the conflict in Ukraine and the ensuing supply chain

and energy price shocks, central banks raised interest rates in the face of

stark inflation readings. As we look to 2023, so far, performance in private

debt has remained steady*. By way of example, default rates in the broadly

syndicated leveraged loan indices in the US and Europe, which serve as a proxy

for private debt, remain at low levels.

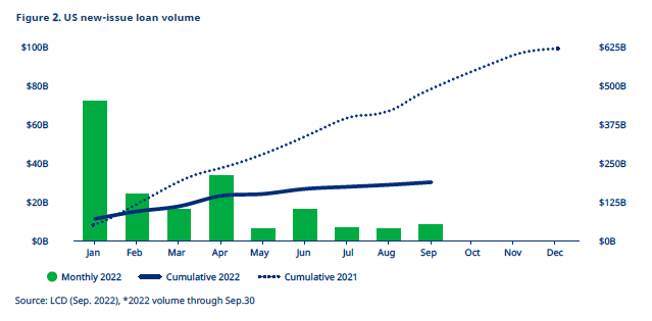

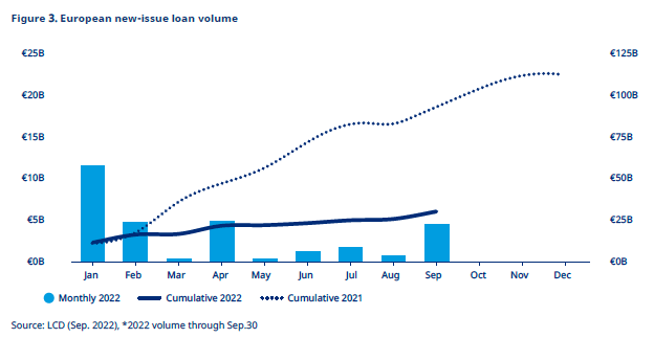

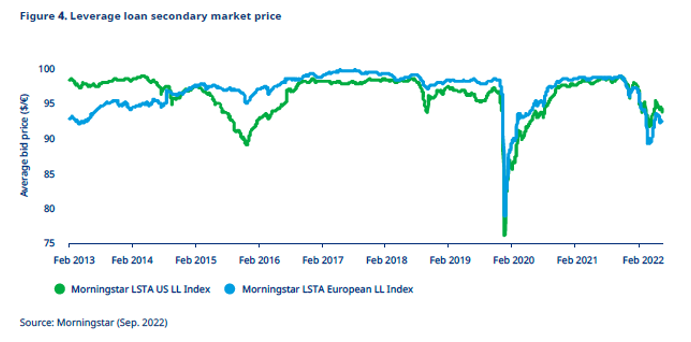

However, a prevailing sense of uncertainty is clearly

reflected in market sentiment, with “traded” loan issuance falling

precipitously compared to the prior year, and the weighted-average bid for

loans falling steadily.

Where pricing volatility becomes a challenge for investors

and financing options are reduced for larger, “liquid” corporate borrowers,

private debt becomes an increasingly viable alternative to the liquid credit

markets. Combined with a predominantly floating-rate structure, private debt

offers one of the few bright spots on investors’ radars, despite the prognosis

for rising default rates across all credit asset classes.

Private debt has demonstrated a premium versus liquid credit

over a long period, often combined with lower default rates and higher recovery

rates.1 Given the current economic backdrop, it’s more crucial than

ever to build your allocation to private debt in the right way. Naturally, diversification

should be a core tenet for any private debt investor, and we strongly advocate

avoiding concentration risk. Taking this approach is playing defense at a time

when the market environment strongly suggests that more dispersion lies ahead —

between asset managers, investment strategies, sectors and portfolio companies.

In this paper, we choose to highlight another, perhaps

underappreciated, tenet for private debt investors: flexibility. A flexible

approach is not only defensive, but, to some extent, it can also be an attack.

To us, flexibility means:

•

Maintaining

broad coverage of the expanding landscape of private debt: Consider where

the imbalance of capital demand and supply is likely to be most acute over the

next 3-4 years. The world of corporate direct lending has traditionally

demonstrated this imbalance: reduced bank lending to the midmarket (supply) and

the rising requirement for debt capital from private equity (demand). As the

world of private debt continues to expand, we see new themes and avenues for

exploiting imbalances that may become even more acute over the next 3-4 years —

structured credit and specialty finance spaces, in particular —therefore

improving risk-adjusted return potential.

•

Cultivating

broader relationships: In the traditional model, investors commit assets to

a narrowly defined investment strategy. Instead, we advocate that investors

access broader credit platforms (that is, an asset manager with multiple credit

capabilities) with the potential to bring a diverse opportunity set together at

a single point of access. An asset manager that can look across its credit

platform has a higher probability of committing the next dollar of capital to the

best risk-adjusted return opportunity. The resulting portfolio should be more

robust, and able to achieve a greater level of diversification. Underwriting

the various underlying capabilities may mean more work, but we believe it is

worth it for the benefit of the overall portfolio.

•

Becoming

a provider of liquidity in stressed or dislocated situations: Periods of

secondary market volatility can escalate as a result of liquidity,

concentration and leverage limitations imposed on other market participants. We

believe opportunistic credit strategies are well placed to meet their higher return

targets when these circumstances proliferate in the wake of a broader credit

market dislocation. Being a provider of liquidity in these situations — whether

through secondary tranches of CLOs or individual broadly syndicated loans —

offers capital gain opportunities while allowing investors to retain a focus on

credit fundamentals and downside protection. The ability to pivot toward credit

dislocation funds, special situations and distressed debt at opportune points

in the cycle can be rewarding.

The

market environment is highly uncertain. In many respects, private debt

currently looks attractive, both on an absolute basis and relative to other

asset classes. However, there will be greater dispersion ahead. Opportunities

will present themselves as the asset class continues to expand and the

macroeconomic picture develops. In conjunction with diversification,

incorporating an element of flexibility into portfolio planning, construction,

and implementation can help private debt investors effectively prepare and

increase the odds of a successful outcome.

Key takeaways

Private debt is currently an attractive asset class, both on

an absolute basis and relative to other asset classes. However, there will be

greater dispersion ahead. Given the current economic backdrop, it is imperative

to build your allocation to private debt in the right way. Naturally, diversification

should be a core tenet of any private debt investor, and we strongly

advocate avoiding concentration risk.

* Past performance is no guarantee of future results.

1 For more information, see https://www.mercer.com/content/dam/mercer/attachments/global/gl-2022-private-debt-report.pdf

Important notices

References to Mercer shall be construed to include Mercer

LLC and/or its associated companies.

This contains confidential and proprietary information of

Mercer and is intended for the exclusive use of the parties to whom it was

provided by Mercer. Its content may not be modified, sold or otherwise

provided, in whole or in part, to any other person or entity without Mercer’s

prior written permission.

Mercer does not provide tax or legal advice. You should

contact your tax advisor, accountant and/or attorney before making any

decisions with tax or legal implications. This does not constitute an offer to

purchase or sell any securities. The findings, ratings and/or opinions

expressed herein are the intellectual property of Mercer and are subject to

change without notice. They are not intended to convey any guarantees as to the

future performance of the investment products, asset classes or capital markets

discussed.

For Mercer’s conflict of interest disclosures, contact your

Mercer representative or see www.mercer.com/conflictsofinterest.

This does not contain investment advice relating to your

particular circumstances. No investment decision should be made based on this

information without first obtaining appropriate professional advice and

considering your circumstances.

Information contained herein may have been obtained from a

range of third party sources. While the information is believed to be reliable,

Mercer has not sought to verify it independently. As such, Mercer makes no

representations or warranties as to the accuracy of the information presented

and takes no responsibility or liability (including for indirect,

consequential, or incidental damages) for any error, omission or inaccuracy in

the data supplied by any third party.

Investment management services for Canadian investors are

provided by Mercer Global Investments Canada Limited. Investment consulting

services for Canadian investors are provided by Mercer (Canada) Limited.

Author:

David Scopelliti

Partner, Global Head of Private Debt, Mercer