16th Private Equity Latin America Forum

Request an Agenda

The 16th Private Equity Latin America Forum is the premier Latin America event designed to enhance financial and investment practices while fostering collaboration within the private equity community.

Join us at the Private Equity Latin America Event, bringing together 300+ LPs for an exclusive, investor-focused experience. Explore key topics such as corporate investments, global infrastructure opportunities, and the role of development banks in private equity.

Learn about liquidity strategies, climate-smart investing, and the growing private debt market in Latin America.

Don’t miss this chance to network with industry leaders and gain valuable insights.

Sign up now to secure your spot!

OUR SPEAKERS

Keynote Speakers

George Santoro

Brazilian Government

Executive Secretary of Ministry of Transport

George Santoro is the Executive Secretary of Brazil’s Ministry of Transport and has a strong academic background in law, business administration, economics, and accounting, with specializations from renowned institutions in Brazil, the U.S., China, and Singapore. He led Brazil’s first sanitation concession project under the new regulatory framework in Alagoas and currently oversees the world’s largest portfolio of transport infrastructure projects. He’s Leading a package of railway concessions focusing on the Central-West and North regions, crucial for the flow of grains and other commodities. He has also overseen the establishment of a national commission to monitor rail projects planned and implemented by Brazil's freight concessionaires, ensuring effective oversight and progress in the railway sector.

Series Keynote Speakers

Francisco Alvarez-Demalde

Riverwood Capital

Co-Founder & Managing Partner

Francisco Alvarez-Demalde is a Co-Founder and Managing Partner of Riverwood Capital, one of the leading global investment firms solely dedicated to technology growth and scalability. Mr. Alvarez-Demalde co-heads the Firm and has been involved in the scalability journey of several of Riverwood’s portfolio companies since its inception in 2008, as a partner to founders and management teams helping scale companies from the $10s of millions to the $100s of millions or more in revenues. During the past decade, Riverwood has been an active investor in more than 80 technology companies, which have grown their revenues at ~40% per year on average during Riverwood’s hold period. Prior to establishing Riverwood, Mr. Alvarez-Demalde was an investment executive at Kohlberg Kravis Roberts & Co. (KKR), where he focused on leveraged buyouts in the technology industry and other sectors. He was also with Goldman Sachs & Co. Mr. Alvarez-Demalde has invested and been involved in the development, operations, and growth of several successful businesses across North America, Latin America and other geographies. Mr. Alvarez-Demalde earned a Licentiate (Honors) in Economics from Universidad de San Andres, Argentina (including an exchange program at the Wharton School). He has led investments in or is a current or former Director or Advisor of several technology companies and institutions, including 99, Alog Data Centers do Brasil, BigID, Billtrust (Nasdaq: BTRS), Cloudblue, Dock, Globant (NYSE: GLOB), Greenhouse, Industrious, Insider, LAVCA, Mandic, MotionPoint, Navent, Pixeon, RD Station, SecurityScorecard, Shiphero, SUMA, Technisys, VTEX (NYSE: VTEX), among others. Mr. Alvarez-Demalde is also a Global Ambassador with Endeavor, on the board of Him for Her, Founder of LTF and Digitar, and interested in non-profit initiatives related to education.

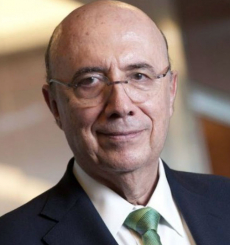

Henrique Meirelles

São Paulo (Former Minister of Brazil)

Secretary of Finance & Planning

Mr. Henrique Meirelles is a Brazilian economist and politician with a prominent career in both the

public and private sectors. He served as Brazil's Minister of Finance from 2016 to 2018, playing a

crucial role in the country's economic reforms. Prior to that, he was President of the Central Bank

of Brazil from 2003 to 2011, where he helped stabilize Brazil's economy. Meirelles has also held

top positions in international finance, including as CEO of BankBoston. He ran for president in

Brazil’s 2018 elections but was not elected. Henrique Meirelles is currently a member of Binance's

Global Advisory Board, a position he took up in September 2022. This role allows him to leverage

his extensive experience in global finance to provide guidance on regulatory and compliance issues related to the cryptocurrency industry. As Secretary of Finance & Planning for São Paulo

state, his responsibilities include managing infrastructure projects and promoting both local and

international investments.

Juan Pablo Zucchini

Advent International

Managing Partner & Chairman of the Latam Investment Committee

Mr. Zucchini joined Advent in 1996. From 2001 to 2003, he was a Director in the São Paulo office,

focusing on the services sector. From 2003 to 2007, he worked in the Buenos Aires office, and

seven years ago he returned to Advent's São Paulo office. Before joining Advent, Juan Pablo

worked at Grupo Perez Companc, where he participated in several privatization projects in Argentina, particularly in the oil & gas and energy industries. Juan Pablo has been involved in 21 of Advent's investments, including EBANX, Grupo Fleury S.A., Grupo Biotoscana, Grupo Farmaceutico

Somar, Neoris, Prisma Medios de Pagos S.A., Skala Cosméticos, and Sophos Solutions.

Mansueto Almeida

BTG Pactual & Former Secretary of the Treasury of Brazil

Partner and Chief Economist

Mansueto Almeida, economist and entrepreneur, is the Chief Economist and Partner at BTG Pactual bank. Beginning in 2018, he also served as Secretary of the National Treasury during Michel Temer's administration and remained in the role after President Jair Bolsonaro was elected, holding the position until 2020. The economist also served as head of the Economic Monitoring Secretariat, a state body responsible for addressing issues such as the country’s economic reform, factors directly linked to improvements in Brazil’s investment grade. Almeida is also known for his outstanding work at the Institute for Applied Economic Research (Ipea), having previously served as General Coordinator of Monetary and Financial Policy at the Economic Policy Secretariat of the Ministry of Finance and as advisor to the Senate’s Regional Development and Tourism Commission.

Past Speakers

Andres Ackermann

IDB Invest

Head of Investment Funds

Mr. Ackermann has worked at the IDB Group since 2009 focusing on financial markets in Latin America and the Caribbean. Currently, he leads the investment fund business of IDB Invest, including private equity and private debt. Andrés is a member of the investor advisory committees of various private equity and debt funds in which IDB Invest holds equity. Before IDB Group, he worked as Corporate Banking Manager and Corporate Finance/Capital Markets Manager at Citibank in Bolivia and as Middle Market Banking Manager and Financial Planning Manager at Banco de Crédito.

Arslan Mian

BlackRock

Managing Director

Arslan Mian, Managing Director, has over 25 years of private equity experience and has been with BlackRock Private Equity Partners (“PEP”) since 2005. He heads Americas’ investment team for PEP. He is also a member of PEP’s Investment Committee, Management Committee and Executive Committee. Since inception, PEP has raised over $45bn of commitments for private market investments across primary funds, secondaries and direct investments. Prior to joining PEP, he worked at various groups within UBS and TD including Private Equity, Financial Sponsors and M&A. Mr. Mian holds an MBA from University of Oxford’s Said Business School where he was a Rhodes Scholar and a BEng in Aeronautical Engineering (with distinction) from the College of Aeronautical Engineering, Pakistan.

Fabio Kono

BNDES

Senior Advisor to the Infrastructure, Energy Transition and Climate Change Division

Gastão Valente

GIC

Managing Director

Mr. Valente is MD and Brazil RE Head. He’s been with GIC since 2013, and has over 30 years of professional experience, 18 of which in real estate investments. He was director of BTG Pactual, worked with foreign trade and at Deloitte Consulting. He is an economist graduated from PUC-Rio and has a master's degree in Economics with an emphasis in Finance from the University of Montreal.

Lauritz Stræde Hansen

IFU

Senior Investment Manager

Manuel Reyes-Retana

IFC

Regional Director, Latin America

Manuel Reyes Retana is IFC´s Regional Director for South America, covering Brazil, Ecuador, Peru, Bolivia, and the Southern Cone. He leads the implementation of IFC’s strategy in the region, including our investment and advisory operations.

Mario Malta

Advent International

Managing Director

Mario Malta joined Advent in 2003 and is the Managing Director responsible for investments in the Business and Financial Services Sector across Latin America. Mario has worked on 19 Advent investments including Easynvest, Nubank, EBANX, Grupo Cataratas, Cetip, GHL, LifeMiles, Nielsen and TCP, and sits in the Board of Director of EBANX. Former Directorships include Easynvest, Grupo Cataratas, Atmosfera, LifeMiles, Prisma, and TCP. Mario received a BA in Business Administration from Fundação Getúlio Vargas (EAESP– Escola de Administração de Empresas de São Paulo) with majors in Corporate Finance and Corporate Strategy.

Michel Freund

Bain Capital

Private Equity Partner

Rodolfo Baca

ONP – FCR (Peruvian Public Pension Fund)

Chief Risk Officer

Sergio Gusmão Suchodolski

VR Investments

Partner, ESG Director

Mr. Suchodolski is the Executive Vice President of VR Investments. He is also a Global Fellow at the Wilson Center and a Senior Fellow at the Brazilian Center for International Relations, CEBRI. Previously he was the CEO of the Development Bank of São Paulo, Brazil. Prior to that he was CEO of the Development Bank of Minas Gerais (BDMG), Brazil and before that he was Director General, Strategy and Partnerships, at the New Development Bank in Shanghai, China. Earlier in his career, Mr. Suchodolski held senior positions in the public and private sectors in New York, Brasilia and Geneva.

Tania Chocolat

CPP Investments

Managing Director, Head of São Paulo Office, Head of Active Equities Latin America

Mrs. Chocolat is the Head of São Paulo office and is also responsible for leading and

overseeing the Active Equities Investments Latin America group. Prior to joining CPP Investments in 2017, Tania was responsible for Private Equity

investments in Brazil at Capital Group. Before that, Tania held various positions at Itaú

Unibanco in the Investment Banking, Research and Private Banking Divisions, and was

a financial analyst in the Investment Banking Department at J.P. Morgan. Tania holds a BA in Industrial Engineering from Escola Politécnica da Univerdade de

São Paulo. Tania is currently a Board Member of Equatorial Energia,Totvs, LAVCA and OSESP.

Yoshi Kiguchi

Pension Fund of Japanese Corporations

Chief Investment Officer

Yoshi focuses innovative strategies and products with the investment horizon structures. He has more than 35 years of experience in investment and risk management. Before that, Mr. Kiguchi was a managing director of Russell Investments in Japan, where he supervised several teams, and delivered a wide range of consulting and solutions to the institutional clients including Toyota, Fujitsu, NEC, Sekisui, Toray, and Mazda. He joined Russell as a consultant in 1998.Prior to joining Russell, Mr. Kiguchi was with Sumitomo Life for ten years. He was placed in charge of corporate strategy, equity investments, researching capital markets, including private equities, and performing quantitative risk management and ALM.B.S., Precision Machinery (Robotics), the University of Tokyo, 1988.

Rosewood São Paulo

Rua Itapeva, 435

Bela Vista

São Paulo, SP

Brazil, 01332-000

Client Testimonials

Our clients love us, here are a few of their quotes.

Our Sponsors

Platinum Sponsors

Lexington Partners

Lexington Partners is one of the world’s largest and most successful managers of secondary private equity and co-investment funds. Lexington helped pioneer the development of the institutional secondary market over 30 years ago and created one of the first independent, discretionary co-investment programs 26 years ago. Lexington has total capital in excess of $76 billion and has acquired over 5,000 interests through more than 1,000 transactions. Lexington’s global team is strategically located in major centers for private equity and alternative asset investing across North America, Europe, Asia and Latin America. Lexington is the global secondary private equity and co-investments specialist investment manager of Franklin Templeton. Additional information can be found at www.lexingtonpartners.com.

Willkie Farr & Gallagher – LATAM

Willkie provides strategic legal representation and trusted counsel to market-leading public

and private companies operating around the world. Our attorneys work seamlessly across

practices and borders to deliver efficient and effective solutions to complex problems. Working

closely with clients, we promote their interests, protect their rights and position them for current success and long-term growth. Willkie’s Latin America practice group possess the legal

acumen and experience to handle any transaction, and are valued for their ability to communicate effectively with clients in Latin America and internationally. Our lawyers are admitted

throughout Latin America and have significant experience working on a variety of matters in

the region, including in Argentina, Brazil, Chile, Colombia and Mexico. All attorneys in our Latin America practice are either fluent or proficient in Spanish and/or Portuguese.

Gold Sponsors

BDO

BDO is the fifth-largest audit, consulting and tax company - both nationally and internationally

- and the leader in the middle market sector. In 2023, BDO had global revenues of c. US$14

billion, around 1800 local offices distributed across over 160 countries, and approximately 111

thousand professionals. In Brazil, it has over 2000 professionals and 28 offices.

Candido Martins Cukier

Candido Martins Cukier is a transactional law firm with solid experience in mergers and acquisitions, private equity, capital markets and estate planning. We listen to the customer with commitment. We understand their needs and position ourselves clearly, creating success stories. Unlike other firms, our purpose has always been to remain as a firm focused on middle market transactions with a full understanding of our clients’ issues and with the fingerprints of our partners throughout all stages of the projects. Although we do focus on middle market transactions, we have been involved in several complex large M&As as well as transactions involving start-ups. Our focus is always on the client and to understand their needs throughout the whole process. We accompany the clients throughout their journeys and always stay with them after the end of the trans-action to assist in several other issues on a more personal level.

Kawa – PELatAm

Founded in 2007, Kawa is a $3B alternative asset manager focused on delivering competitive risk-adjusted returns to investors while maintaining our commitment to transparency, capital preservation and our core principles. Our liquid strategies look to bring meaningful returns with more marketable securities, generally in products which are open-ended and provide regular liquidity to our investors. Offered as Co-investments or closed-ended fund structures, our private investments allow us to take advantage of sometimes fleeting opportunities in Structured Lending and Real Estate Investing.

Industry Partners

Cuatrecasas

Cuatrecasas is a law firm with a presence in 12 countries and a strong footprint in Spain, Portugal, and Latin America, where we have offices in Bogotá, Mexico City, Lima, and Santiago. With a multidisciplinary team of more than 1,300 lawyers and a network of 26 offices, we provide advice in all areas of business law and assist our clients with the most demanding issues, in any territory, offering the experience and knowledge of highly specialized teams.

Key Discussion Topics

Panel Discussion: Liquidity Strategies in Private Equity – Exits, Continuations & Semi-Liquid Solutions

As the private equity landscape evolves, liquidity strategies are becoming increasingly important. What are the exit options available to investors, including strategic sales, secondary market transactions, and continuation funds. How firms are navigating these opportunities to maximize returns while maintaining portfolio value. Semi-liquid structures that offer flexibility and liquidity for investors looking for smoother transitions between different stages of the investment cycle.

Keynote Panel: Powering Growth – Private Equity and the Untapped Potential of Latin America's Natural Resources

Latin America is home to some of the world’s richest natural resources, making it a prime region for private equity investment in sectors like mining, energy, and agriculture. How private equity firms can tap into the immense potential of these resources, navigating the challenges and opportunities that come with them. Experts will discuss how sustainable practices, technological innovations, and strategic partnerships are driving value in resource-focused investments.

Panel Discussion: Uncovering Global Infrastructure Investment Opportunities

Private equity has the potential to make a significant impact in developing world-class infrastructure. In Latin America, foreign investment has surged, driven by the region's steady economic recovery. This panel will examine the long-term return prospects for global infrastructure investments and the key risks investors should consider when navigating these opportunities across diverse markets.

Keynote Panel: Unlocking Value in Latin America’s Private Debt Market

As private debt becomes an increasingly strategic financing tool in Latin America, private equity firms are capitalizing on opportunities in direct lending, structured credit, and special situations. This panel will examine how GPs are structuring deals, navigating economic volatility, and assessing risk in a shifting credit landscape. Experts will also share insights on return expectations, sector-specific opportunities, and the evolving role of private capital in the region’s debt markets.

Panel Discussion: Corporate Investments – A Key Source of Capital for Private Equity

Corporate investors are increasingly becoming one of the most significant sources of capital for private equity, providing both financial backing and strategic value. How corporations are actively engaging in private equity investments, either through direct equity stakes, joint ventures, or strategic partnerships. The benefits include access to industry expertise, market insights, and synergies that enhance growth potential.

Panel Discussion: Catalysts of Growth – Development Banks and Their Impact on Latin American Private Equity

Development banks have become pivotal players in the Latin American private equity landscape, providing crucial financing and support to foster economic growth and development. This panel will explore the role these institutions play in catalyzing private equity investments, particularly in emerging sectors and underserved regions. How development banks are partnering with private equity firms to address funding gaps, enhance infrastructure, and promote sustainable development. Key topics will include risk-sharing mechanisms, impact investing strategies, and how development banks are helping drive innovation and inclusion across the region’s private equity market.

Registration

Media Partnerships

+1 212-600-8631

John.Zajas@marketsgroup.org

Allocator Attendance

+1 347-778-2568

IR@marketsgroup.org

Sponsorship Opportunities

+1 212-804-6220

Sales@marketsgroup.org

Behind the Event

The numbers that highlight Market Group's journey, our impact, and our commitment to exceptional events.